The past two years have brought unforeseen challenges to the foodservice industry, leaving many operators scrambling to adapt. Check out the Canadian Foodservice Trends for 2022 to see where Canadian foodservice is going, what consumers are craving, how operators are continuing to pivot, and what successes they might see in 2022. Will this be the make-it-or-break-it year?

Menu Pivots Support Supply Changes

Persistent supply chain issues will inspire creativity and require flexibility in 2022. Almost a third of foodservice operators surveyed (29%) will raise menu prices by 5% or more over the next twelve months so exploring new ingredients or innovative menu pivots is key moving forward (Source: Restaurants Canada Q2 2021 Outlook Survey) Specifically, quirky preparations of familiar ingredients will allow for exciting menu additions without new SKUs—think pickled apples, candied garlic or salt-baked root veggies to impart new flavours and/or textures while, in some situations, even extending shelf life.

Inventiveness with favourite fare will also help operators stand out such as global sauces and ingredients on classic dishes and less-traditional cuts of meal that are more economical, chicken thigh vs chicken wing.

Stat: Chicken Thighs have seen a 39% increase in menu mentions over the past year

Source: Ignite Menu data, Q3 2020 – Q3 2021

All Buttered Up

As the comfort food trend surges on, many foodservice operators will turn their attention to butter, a staple ingredient in most kitchens. Flavoured butter will be grounds for culinary experimentation, ranging from umami-rich kombu or yeast butters to cocktails featuring herb-infused and browned butters.

Other buttery ingredients such as buttermilk, buttercream, butterscotch and ghee/clarified butter will gain attention. Elevated versions and applications of nut butters will also continue to grow in conjunction with the plant-based trend, with pistachio and macadamia butters finding momentum, and peanut butter making headway in new directions, such as on burgers or in cocktails.

Stat: Buttermilk is on 14% of operator menus and about 2% of operators menu butterscotch or clarified butter

Source: Ignite Menu Data, Q2 2020-Q2 2021

The Breakfast Boom

The crisis may have prompted some chains to cut back on breakfast over the past year, but the daypart is poised for a big bounce back in 2022. With recovery scenarios on the horizon, consumers are settling into a less-disruptive reality, one in which some are fully homebased, while others head back to the workplace. And – crucially – kids are going back to school campuses. For many, sourcing a morning meal from a restaurant is once again a part of the routine.

Expect chains to employ subscription deals, multiperson bundles, product innovation and amped-up marketing to capture morning traffic and establish loyalty. We’ll also see the return of 24/7 breakfast offerings as well as new competition from casual dining in the form of morning-only virtual brands and later-day breakfast options.

Eggs are perfectly suited for a post-pandemic slot in the limelight – simple, universal, craveable, adaptable, suggestive of new beginnings. Eggs also create opportunity for punny concepts and quirky branding, bringing some fun back to the dining experience.

Stat: 62% of Canadian consumers would like breakfast to be offered beyond morning hours

Source: Technomic July 2021 consumer survey, 1,000 consumers

Spicy And Sweet Combinations

Beyond simple heat, operators are creating more complex flavour profiles, including sweet heat, to differentiate. There is growing demand for flavour experimentation and foodservice operators are upping their game by creating unique flavour profiles.

We are seeing more development of spice on the menu including spicy flavours combined with sweet flavours, which make spicy flavours more approachable for those looking for a hint of spice or a moderate spice level. From appetizers to desserts, operators are using ingredients like honey with chili oil and honey with hot sauce to create sweet-and-spicy combinations. Pidgin, located in Vancouver, menus szechuan pepper beignets that comes with sugar dusting, salted caramel and miso sauce.

Technology Boost

Technology has allowed restaurants to adapt to new expectations for contact-free foodservice. Online ordering and delivery have become a necessity for many operators and continues to evolve. More chains are starting to explore automated systems in both the front- and back-of-house, like grab-and-go cubbies from Paramount Fine Foods, or the Spyce Robotic Kitchen, as a way to improve safety during the pandemic as well as alleviate some of the challenges caused by labour shortages.

While many technologies remain cost-prohibitive to smaller operations, online ordering and menu solutions will continue to become more of an expectation for many consumers and are important to consider in strategic growth overall. We can expect further developments around mobile ordering, geofencing and other technologies; more tech-based self-delivery to help independents – especially – better control costs and quality.

Plant-Based Explosion

Plant-based ingredients have seen large increases in menu mentions, but the trend continues to grow further than just proteins. Dairy alternatives like oat milk are trending as well as plant-based condiments and cheeses.

Alternative and plant-based proteins have gained mainstream popularity, with many top chains adding the once-niche ingredients to their menus. Upcoming plant-based innovation includes vegan bacon, plant-based Bolognese, caviar and other non-traditional protein dishes.

Stat: Oat milk has grown 79% in menu incidence this year and plant-based beef has grown 21% in menu incidence

Source: Ignite Menu Data, Q3 2020-Q3 2021

Reliance On Delivery/Takeout Continues

So many restaurants made the pivot to takeout and delivery over the past year, and this will continue to help drive sales for restaurants while some customers remain unsure about indoor dining. More than half of consumers (52%) indicate they will still rely more heavily on off-premise services such as takeout and delivery in the foreseeable future. The number of consumers who indicated they would be avoiding restaurants for the foreseeable future also went up from 23% in March to 25% in May (Source: Foodservice Digest for Canada September 2021).

Many restaurant operators are leaning into footprint innovation with more compact unit prototypes and delivery- or takeaway-only locations. While the threat of new variants and community spread remains a reality, ensuring there are menu items that are portable or more tailored for off-premise occasions will be key in keeping operations flexible as health and safety recommendations continue to shift.

What comes after X and Y? If you said, “Zed” or “Zee,” you would be partly correct. When it comes to demographics, the group order is Boomers, GenX, GenY, and then GenZ. That chronology of labels for the demographic age cohorts makes alphabetical sense, but it misses the bigger picture.

In an extensive profile of GenZ by Global News, GenZs describe themselves in a diverse number of ways. GenZ is a generation unlike any other, and they challenge the notion that they can be understood as a mere extension of GenY (Millennials).

In their own words…

- “We have a unique mindset”

- “Have our own way of thinking”

- “We know what we want”

- “We are creators, innovators, entrepreneurs, and Activists”

- “Technologically impacted”

- “We’re pragmatic, sensible, and seek value for money”

- “We want control”

- “Optimistic about what the future holds — and truly believe we can change it. But we have an emergency fund just in case”

Who’Z the boss?

GenZ may be young, but they’re already smart enough to know that their time is nigh. Consider that by 2026, in the US, GenZ is estimated to represent 23% of the population and become the single largest US consumer segment.

Depending on how you define the cohort, Generation Z makes up approximately 20 per cent of Canada’s population, based on 2017 data from Statistics Canada. In terms of purchasing power, GenZ in Canada directly spends about $50B annually. However, their influence over food decisions extends beyond this.

“We’re pragmatic, sensible, and seek value for money.”

Generation Z

NPD Canada’s analysis of consumer foodservice purchases in 2019, showed that GenZ was responsible for:

- Driving foodservice traffic growth

- Having the highest relative redemption rate of foodservice purchases on deals

- The highest percentage of digital foodservice transactions

Getting to know GenZ

Kevin Stewart, founder of AgVision Media, an agricultural insights and consulting company, has developed a number of insights about GenZ and their impacts on the food industry:

- Their food choices are based on health, animal welfare and environmental sustainability

- They are driving the growth of the popularity of plant-based patties in foodservice and retail

- They “spend more money on food than they do on clothes”

- “They’re looking more towards what they call ‘eating with a conscience'”

- More inclined to order food online than eat at a restaurant – “They want their food on the couch or on the go” — mobility is key

CauZes & effects

He suggests that the coming of age of GenZ will be a significant disruption for the food industry. With GenZ becoming your leading customer demographic, you may do well to question whether you’re in the restaurant business, or if you’re committed to leveraging technology and delivery solutions to meet the food and beverage needs of your clients. Clearly, this trend got turbo-charged as a result of COVID-19.

Foodservice and consumer insights provider Technomic recently published findings of their 2020 Canadian Generational Consumer Trend Report. The report benchmarks the current attitudes and tendencies of GenZ, and documents strategies that large chain operators are already implementing in response.

- Environmentally consciousness is a core value for GenZers

- Among GenZers, plastic reduction is evolving from preference to expectation

- GenZ over-indexes with operators that deliver convenience/mobility and value-for-money

Away from homeZ

It’s clear you’ll want to tap this generation.

My work/life balance does not permit me to prepare and/or eat my meals at home (by Age Group):

| 1. GenZ (Born 1996 and later) | 51% | ||

| 2. Millennials (Born 1977 to 1995) | 34% | ||

| 3. GenX (Born 1965 to 1976) | 20% | ||

| 4. Boomers (Born 1946 to 1964) | 12% | ||

Compared to last year, I generally eat outside my home more often than I used to (by Age Group):

| 1. GenZ (Born 1996 and later) | 51% | ||

| 2. Millennials (Born 1977 to 1995) | 30% | ||

| 3. GenX (Born 1965 to 1976) | 13% | ||

| 4. Boomers (Born 1946 to 1964) | 11% | ||

Source: Dalhousie University Study: Disintegration of food habits, 2018

The future is now

If it feels like you were just being told about Millennials and the importance of that segment to your foodservice business, you wouldn’t be wrong. One of the unanticipated consequences of the adversity brought by COVID-19 has been to confirm that change is the only constant in foodservice.

Foodservice has shown a remarkable ability to quickly adapt operations in a myriad of ways. However, in a post-COVID world, the GenZ tsunami will rise fast. By all accounts, GenZ will lean heavily into disruption, with a generational understanding of their power to demand the reinvention of foodservice to meet their unique needs.

Ghost kitchens (also called virtual kitchens, cloud kitchens, dark kitchens) are delivery-only spaces that have the back-end without the front. No seating areas, no counters, no servers, no real “ambience,” not even a physical takeout space.

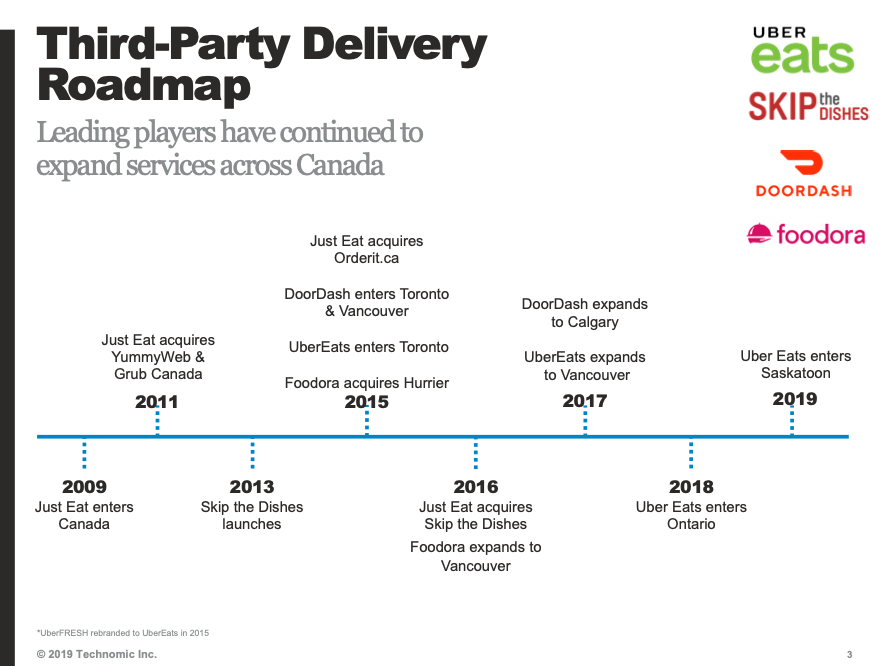

In a society where the sharing economy is growing more important and driving innovation, it’s an idea for our times. Everything is ordered online, prepared in the ghost kitchen, and delivered by third-party marketplaces like Uber Eats, Skip the Dishes, DoorDash and Foodora. Customers interact with the delivery company only. (See Exhibit 1.)

This technology-driven concept lowers overhead for staffing and site costs. As rents have gone up and margins shrink, more operators are enticed by the lure of doing away with front-of-house expenses. In short, it can make the numbers work where they might not otherwise. But there can be challenges if not done properly.

Virtual flexibility

Depending on the brands being served, ghost kitchens can turn out more than one type of cuisine and can feed various menus or sites. That’s especially appealing if you want to move efficiently from one market segment to another to take advantage of trends and growth. And it can be a great way to help counter the ebb of seasonal fluctuations.

“Chefs and restaurateurs have to maximize their capacity,” says Dana McCauley, associate director of new venture creation, University of Guelph. “You’ve got an asset that you need to run as many hours a day as possible to make the numbers work.”

Focusing on making, delivering and marketing food while reducing overhead is a saavy strategy, McCauley observes. “Today’s technology is making it possible. A solid online presence through websites and Instagram and various services are offsetting the importance of neighbourhood storefront locations to build visibility and diner loyalty.”

“Virtual kitchens are a blend of technology plays and restaurant plays.”

Sterling Douglass, co-founder and CEO of restaurant-tech company Chowly

Technology feeds operations

To succeed, ghost kitchens require a tech setup that fits with their operational flow. “Often, virtual kitchens are being run by technology companies and missing key operational steps,” says Sterling Douglass, co-founder and CEO of restaurant-tech company Chowly.

“Virtual kitchens are a blend of technology plays and restaurant plays,” Douglass says. “The teams building these technologies need a significant amount of experience in both areas. Lacking in technology experience will hurt volume and affect operations. Lacking in restaurant experience will decrease food quality, margins, and guest experience.”

He recommends operators answer the following key questions:

- How are concepts separated?

- How are they communicated to cooks?

- How are they bagged and prepped differently?

- How is the driver handoff different?

Know what you don’t

Ghost kitchens present a learning curve for bricks-and-mortar restaurant operators and those new to the industry. That includes everything from understanding the different labour costs to juggling multiple third-party services which are delivering the food.

Thinking about entering the ghost kitchen sphere? Chowly CEO Sterling Douglass offers four pointers:

- Concepts should be data driven

- Menus should be small and VERY simple

- POS integration is a must-have

- A very deep margin analysis should be conducted before launching

Delivery services typically take a 30 per cent cut from every order, though larger operations can negotiate more favourable rates.

On the virtual edge

Ghost kitchens can be found in shared commissary spaces and back ends of storefronts, and some other places, too:

- Popup cooking stations within the main kitchen of a restaurant that fill delivery-only orders from one, two or even a half dozen brands.

- Pod kitchens in shipping containers that can be placed wherever zoning permits. Some double as drive-throughs.

It will be important that operators can efficiently serve both dine-in consumers as well as those ordering takeout or delivery. Also, expect to see more restaurants forego dine-in altogether and experiment with delivery-only stores, especially in partnership with third-party delivery services.

Exhibit 1. (Referenced in article)

How do foodservice operators plan for the unknowable? While not recommended, surviving a previously unimaginable experience — like the first wave of a pandemic — is one way.

Before Canada confirmed its first COVID-19 case in late January 2020, dining out was something operators and patrons took for granted. But in March all provinces prohibited in-restaurant dining. During the summer, eateries could reopen, but with restrictions in place.

As we face the unknowns of the upcoming colder months, it’s timely to reflect on lessons for the foodservice business learned during the pandemic to date:

Income and expense management

Statistics Canada reports that sales in foodservice and drinking establishments fell 36.6% in March. David Lefebvre, VP, federal & Quebec for Restaurants Canada, says a top lesson is “the necessity to have multiple streams of income.” Operators who were able to pivot to alternative income strategies like takeout, delivery, grocery services, and meal boxes were generally more successful.

Both Lefebvre and Jeff Dover, principal of foodservice and hospitality consultants fsSTRATEGY INC., point to the need to also reduce expenses to withstand lower revenues.

Communicating protocols and compliance

Communicating safety measures is increasingly important, Dover says. “Best practice has become making sure cleaning and sanitation is visible,” for example, by seating guests at unset tables and then giving them disposable menus and sanitized cutlery.

Lefebvre advises operators to respect all public health requirements, “because you definitely don’t want a second wave to close you. We want to make sure that restaurants are seen as part of the solution, not part of the problem.”

Customer relations and experience

The pandemic has highlighted the importance of the core relationship with the customer, Lefebvre says. Patrons want to support restaurants they have good relationships with. Dover advocates that operators connect proactively with their guest base and listen to their feedback.

Sylvain Charlebois, senior director of Dalhousie University’s Agri-Food Analytics Lab, says restaurants have been open and transparent in communicating their need for support to the public. “The tone was right too, and I think people showed up.”

Despite measures like physical distancing, masks and plexiglass barriers, guests can still enjoy the customer experience while feeling safe. Charlebois says operators have “done a pretty good job just allowing people to forget about things and relax and enjoy their time there.”

Staff relations

As Lefebvre notes, operators with positive labour relationships were better able to survive pandemic-related business disruption. This included closures, operational changes, the impact of government support programs like work-sharing agreements, and a more challenging work environment.

Embracing technology

Customer demand for contactless payment increased during the pandemic, and Dover says embracing technology is a major lesson. “Mobile order and pay, apps, websites, etc. were around before the pandemic and increasing in popularity; however, adoption rates have soared. We are three years ahead in technological acceptance to where we were before the pandemic.”

“We want to make sure that restaurants are seen as part of the solution, not part of the problem.”

David Lefebvre, VP, federal & Quebec for Restaurants Canada

These lessons have better prepared operators for the fall and winter challenges ahead, including the end of patio season, ongoing physical distancing, PPE requirements, and changes to government support programs.

What about future catastrophes?

But has the pandemic better prepared Canada’s foodservice operators to survive as yet unknown catastrophes like fires, floods, or other public health crises?

Charlebois points to foodservice operators’ collective resiliency. And Dover says, “going through the COVID pandemic will make operators better prepared for the next challenge; however, I think operators are able to react to whatever challenges come.”

Lefebvre says the pandemic itself has been a worst-case scenario, and those who survive it will be better at making contingency plans for future worst-case scenarios.

What do Hank Aaron, Bill Clinton, Mike Tyson, Thomas Edison, and Nikola Tesla have in common? The tie that binds them is their vegetarian/vegan diet.

Our ancestors started eating meat about 2-½ million years ago — probably as scavengers, having stumbled upon a half-eaten carcass. Since then, we’ve been omnivorous — eating a mixed diet of meat and plant-based foods.

It wouldn’t be an exaggeration to suggest that consumption of meat was the key to our success as a species. Mark Thomas, professor of evolutionary genetics at University College London, estimates that the human brain grew three times in size after introducing meat into our diet. Our larger brains enabled higher cognitive abilities, which facilitated our ability to compete and propogate within hunter-gatherer social groups.

As CBC producer Kevin Ball opined in his podcast, The Matter of Meat, for humans “there was a correlation between IQ & BBQ.”

Plant by numbers

In the Autumn of 2018, Dalhousie University published an extensive report on the eating habits of Canadians. At that time, roughly 7 per cent of Canadians considered themselves vegetarians and roughly 2 per cent identified as vegans. More than half of these vegetarians/vegans were under the age of 35.

In addition, the study found:

- Over six million Canadians reported dietary preferences which reduce or eliminate meat consumption

- Fully one-third of Canadians were thinking of reducing their meat consumption over the next six months

- The majority of Canadians had considered making an effort to reduce meat consumption

The report’s author, Dalhousie University’s Dr. Sylvain Charlebois, has followed on with regular fieldwork over the last two years, to plot this trend. Based on the research conducted in January 2020, Dr. Charlebois estimates vegans now represent 2.5% of the population, and that over 16M Canadians could potentially be following a diet that restricts or eliminates meat consumption by 2025.

“…vegans now represent 2.5% of the population, and… over 16M Canadians could potentially be following a diet that restricts or eliminates meat consumption by 2025.”

Dr. Sylvain Charlebois, Dalhousie University’s

Online community

Increasingly, we live our lives online. Social media provides a powerful window into the collective zeitgeist.

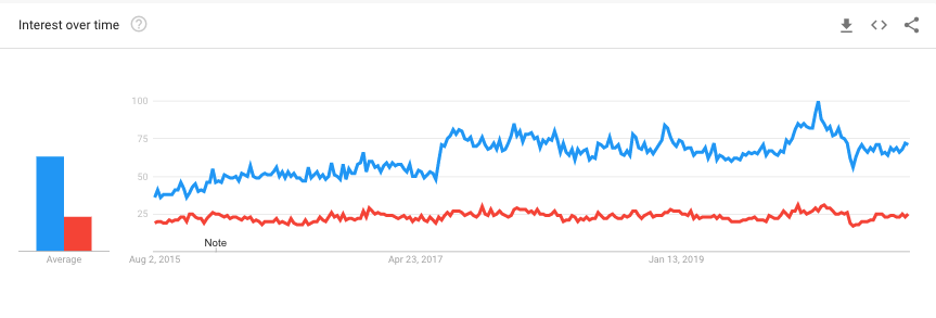

According to Google Trends, over the last five years “Vegan” has been trending up as a web search topic, while “Vegetarian” has been relatively stable and reflecting less interest among consumers.

The Google Trends graphic displays interest relative to the highest point on the chart for Canada since 2015. Vegetarian has had a value of 25 relative to the peak value of Vegan, indicating about one-quarter the amount of search incidence. The data underscores the growth of Vegan, with particular strength in BC and Ontario.

Google Trends — Canadian Web Searches for “Vegan” and “Vegetarian”

Pinterest Canada Account Director Ashley Shantz reports that more people than ever before are turning to Pinterest for well being and self-care, and that includes trying new lifestyles such as veganism. Pinterest searches for veganism in Canada were up +50% in June 2020 compared to the prior year.

Veganuary

“Veganuary” is a registered British charity encouraging consumers, at the beginning of each year in the month of January, to try a 30-day vegan plant-based diet. In 2020, over 400,000 consumers from nearly 200 countries signed up for the challenge, up from 250,000 in 2019. The highest participating countries were the U.K., U.S., and Germany. In 2018, 5,500 Canadians signed up for the challenge. This number rose to over 7,000 in 2019.

In the 2020 follow-up survey with participants, it was reported that the biggest challenge to sticking to their vegan diets during Veganuary was “eating out.” Given that nearly 75% of participants stated their intention to “continue with a vegan diet after (their) Veganuary pledge,” the opportunity for foodservice operators to expand vegan and plant-based offerings is clear.

Staking a claim

According to Technomic Canada’s Ignite Menu database, there has been a +10% increase in operators menuing plant-based items in Q2-2020 versus Q2-2019. Sophie Mir, associate editor at Technomic, reports that plant-based menu mentions increased by over 25% year-over-year.

The upscale BC-based chain, Earls, has embraced the vegan opportunity. Earls introduced a permanent, dedicated vegan menu in all its restaurants in 2018, including Spicy Tofu Tacos, a Crispy Tofu Zen Bowl, Avocado Toast, a Vegan Field Greens Salad, Vegan Hunan Kung Pao, and a Vegan Quinoa and Avocado Power Bowl.

Earls has also mirrored popular menu items, like its Dragon Roll, in a vegan-friendly version: The Green Dragon Roll – with yam, mango, and cucumber, topped with nori.

Where there’s fire

Increasingly, it appears, the pro-plant arguments are finding broader ground. As an operator, there is another very practical justification for meeting the emerging demand for vegan fare. Given the higher margins to be made on meat-free appetizers, sides, and centre-of-plate items, expanding your plant-based menu may add juice to both your top line sales and bottom line results.

While it’s likely that our long-ago ancestors initially started eating meat by accident, it is now, ironically, an evolved understanding and more informed sensibilities guiding us back to our herbivorous roots.