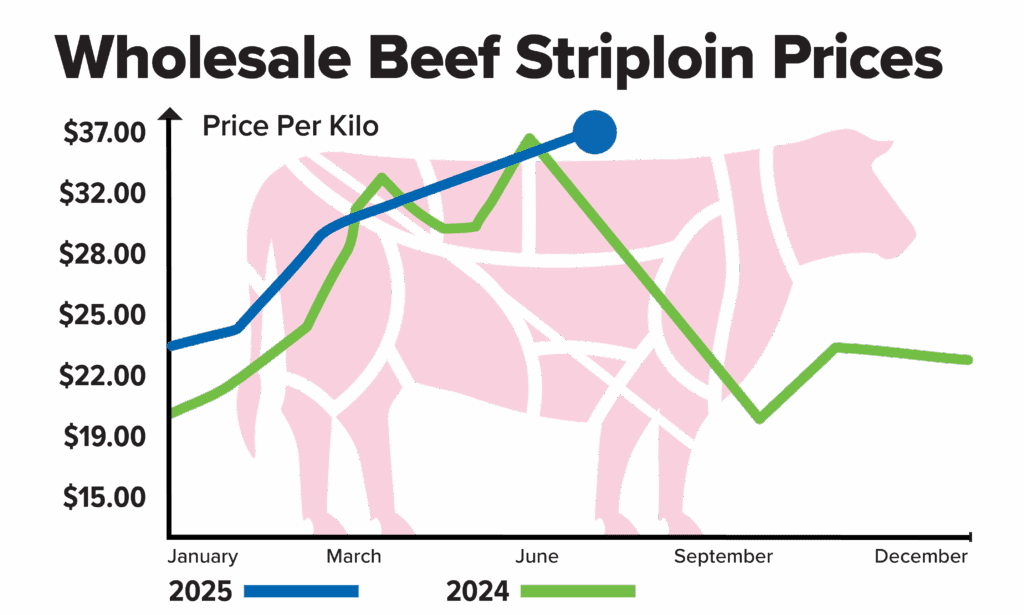

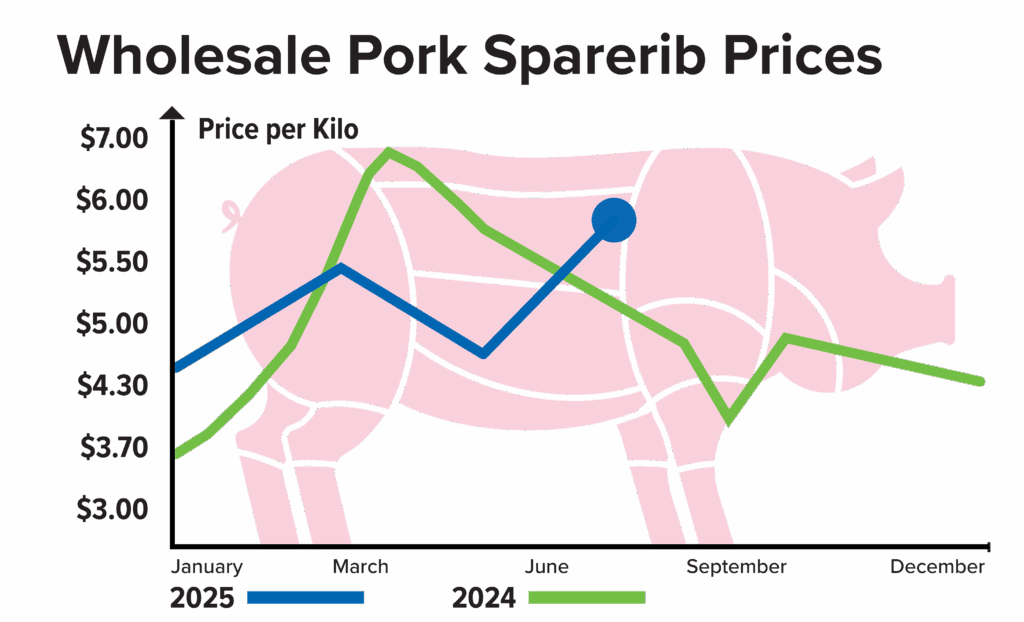

Please note there will be a delay in the reflection of pricing trends at local distributors, attributed to the timing of inventory turnover and the arrival of new stock at distribution centers.

BEEF COMMODITY MARKET REPORT

Beef Insights

July 1, 2025

What’s Happening?

Foodservice operators are contending with beef prices that are up over 16% year-over-year, well above the overall inflation rate. This surge is driven by tight cattle supplies and strong summer grilling demand. Striploins, tenderloins, and ribeyes remain in high demand as patios open and operators promote premium BBQ offerings. However, these prices are eroding the margin potential for smaller restaurants. Many are shifting toward lower-cost cuts or smaller portions to stay competitive.

What Can You Do?

- Balance the Menu with Smart Cuts: Offer more affordable alternatives like sirloins or marinated flank steak to offset premium cuts.

- Control Costs Through Portioning: Cut portion sizes slightly and present plates with bold sides to maintain perceived value.

- Monitor Weekly Prices: Work closely with your distributor sales rep to stay informed on volatile markets and adjust menus accordingly.

Menu Suggestions

- Grilled Flank Steak Tacos with Charred Corn Salsa

- Sirloin and Chimichurri Sliders with House-Cut Fries

- Summer Steak Salad with Pickled Onions and Blue Cheese

- Korean BBQ Beef Tips over Jasmine Rice

PORK COMMODITY MARKET REPORT

Pork Insights

July 1, 2025

What’s Happening?

Pork pricing is steady but creeping upward in certain categories. Loins and ribs are seeing renewed interest as operators turn to pork for value amidst high beef prices. Bellies remain firm, supported by continued increased foodservice demand for bacon. Supply is expected to improve in late summer, but short-term availability has been inconsistent, with processors signaling tighter yields. Although domestic production has improved, processors continue to prioritize export contracts, resulting in additional price pressure on some cuts.

What Can You Do?

- Embrace Pork as a Feature Protein: Present it as a flavourful, cost-effective option in signature dishes.

- Capitalize on Familiarity: Ribs, chops, and pulled pork are consumer favourites that can elevate margins.

- Experiment with Ethnic Flavours: Asian, Latin, and Caribbean pork preparations can differentiate your menu.

Menu Suggestions:

- Pineapple-Glazed Pork Ribs with Cilantro-Lime Slaw

- Pulled Pork Arepas with Pickled Vegetables

- Miso-Ginger Pork Tenderloin with Udon Noodles

- BBQ Pork Chops with Apple Butter and Roasted Potatoes

POULTRY COMMODITY MARKET REPORT

Poultry Insights

July 1, 2025

What’s Happening?

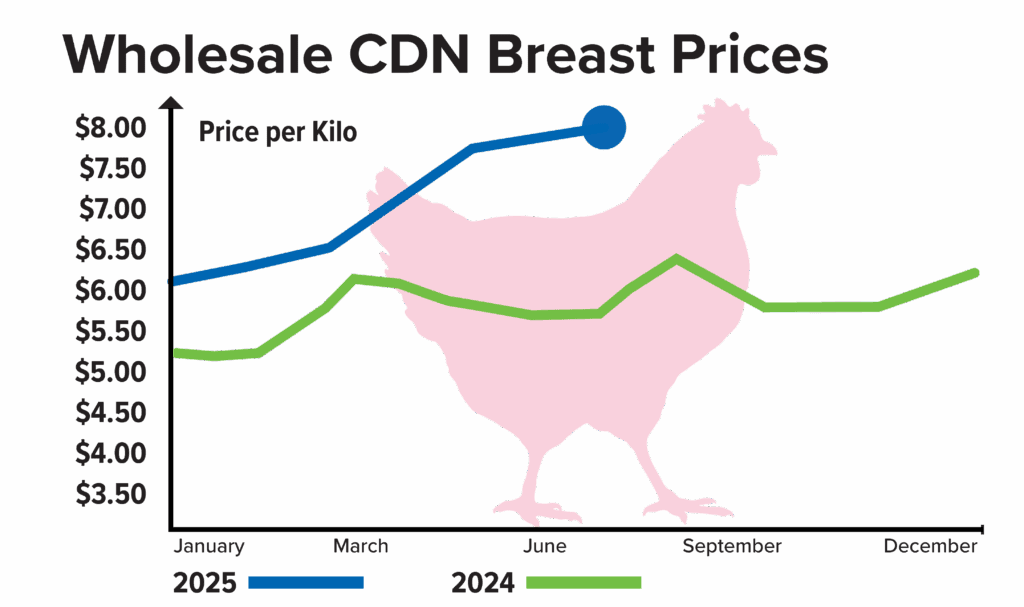

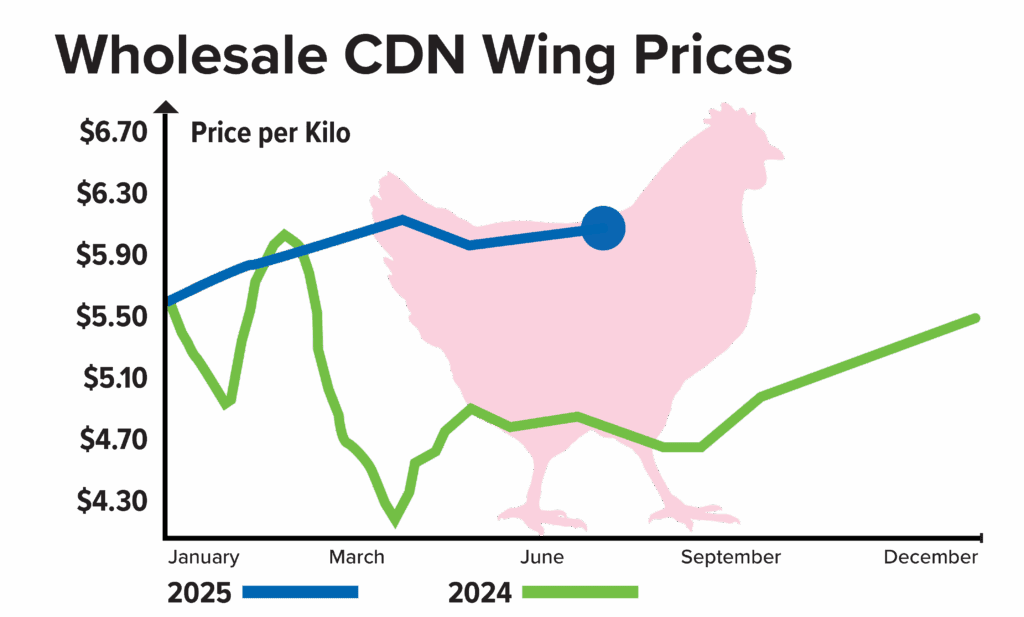

Poultry continues to outperform other proteins on value, but supply remains tight in the foodservice channel. Chicken breast and wing prices are creeping upward in most provinces as demand climbs with summer menus. The impact of reduced hatch rates earlier this year is still being felt. Retail pressure also remains strong, putting additional pressure on prices.

What Can You Do?

- Diversify with Dark Meat: Thighs and drumsticks offer strong margins and menu flexibility.

- Utilize Prepared Chicken Products: Pre-marinated and cooked formats save time and reduce waste.

- Seasonal Specialties Sell: Lean into grilled and BBQ applications during summer.

Menu Suggestions:

- Grilled Chicken Thighs with Chimichurri and Couscous

- Crispy Buttermilk Wings with Maple-Hot Sauce

- Summer Chicken Caesar Flatbread

- Lemon-Rosemary Chicken Skewers with Tzatziki

SEAFOOD COMMODITY MARKET REPORT

Seafood Insights

July 1, 2025

What’s Happening?

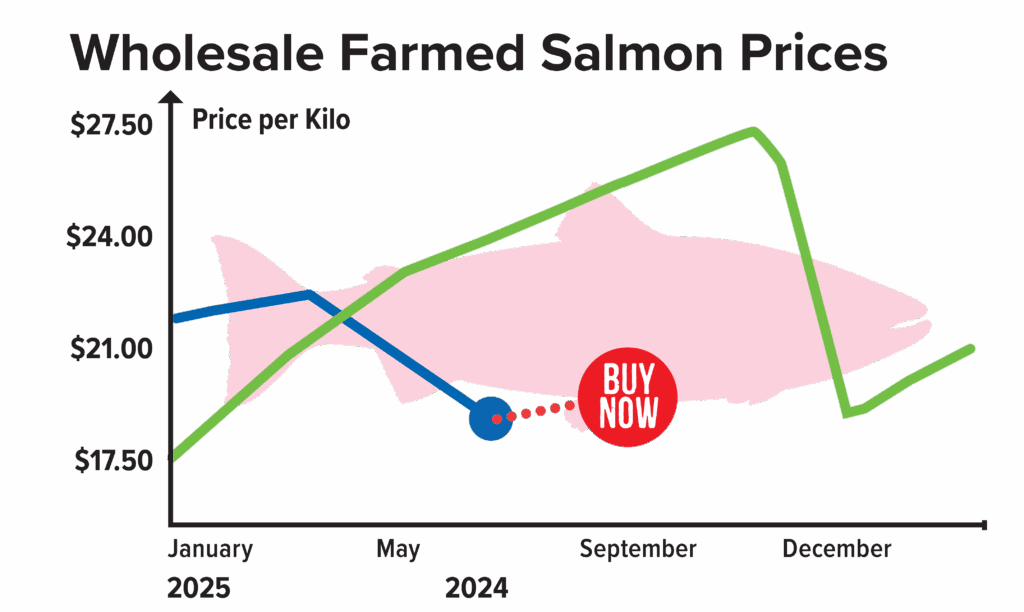

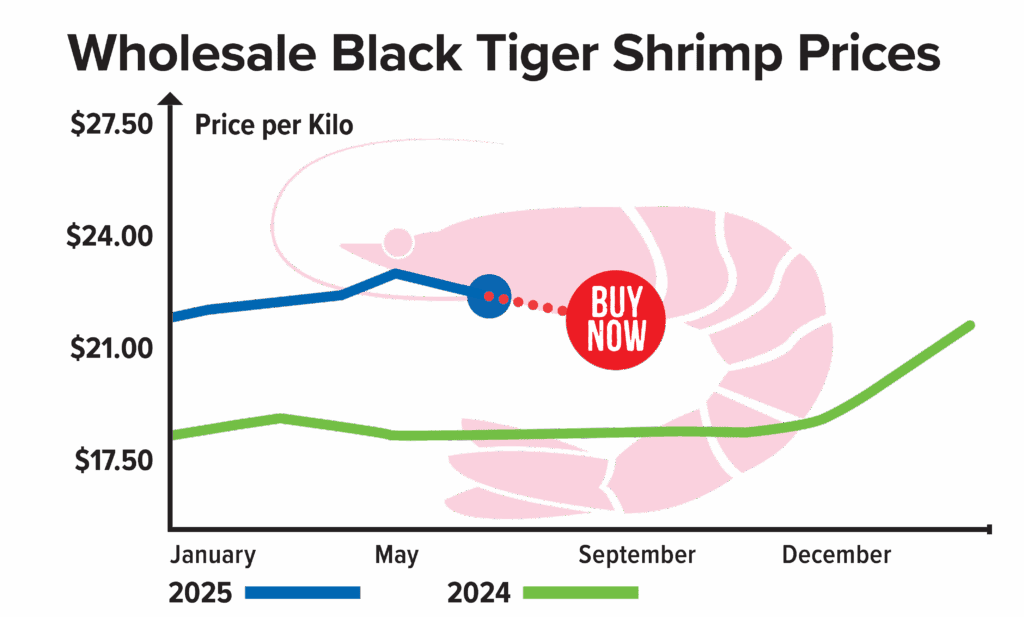

Seafood prices are mixed heading into July. Salmon prices are softening slightly due to improved harvest volumes, while cod and haddock remain firm. Lobster and crab costs are elevated with strong summer demand. Tilapia and pangasius [Vietnamese catfish also known as Swai or Basa] remain reliable lower-cost options. Supply chain fluidity has improved, but global pressures still impact some imported species.

What Can You Do?

- Menu for Value and Sustainability: Choose underused, sustainable species that offer cost savings.

- Promote Freshness with Simplicity: Light summer prep styles (grilled, seared, poached) showcase flavour and keep costs low.

- Lean on Frozen Inventory: IQF and value-added formats offer price stability and prep efficiency.

Menu Suggestions:

- Seared Cod with Summer Ratatouille

- Grilled Salmon with Dill Crème and New Potatoes

- Tilapia Fish Tacos with Slaw and Mango Salsa

- Crab Cakes with Herb Aioli and Watermelon Salad

PRODUCE COMMODITY MARKET REPORT

Current Key Produce Market Trends

General 2025 Trend

- Vegetable prices expected to increase by 5-7% in 2025

- Fruit prices expected to increase by 1-3%

What’s Happening?

Weather variability across North America is driving localized shortages and modest price increases, particularly in lettuces, berries, and corn. Growing region transitions in California and Mexico are adding further strain to some categories. High temperatures and shifting harvest zones are impacting quality in peppers, leafy greens, and soft fruit. Operators should expect price fluctuations through July.

Local produce season is starting to pick up, but spotty yields and high demand are keeping prices above seasonal averages.

What Can You Do?

- Flex Menus Based on Availability: Use specials to showcase seasonal, abundant produce.

- Choose Versatile Vegetables: Items like cabbage, carrots, and zucchini stretch across applications.

- Maintain Close Communication: Ask your distributor sales rep for weekly updates to guide menu planning and substitutions.

Price Alerts as of July 1, 2025

- Lettuce (All Types): Prices remain high; romaine and iceberg yields are erratic due to California heat stress.

- Corn: Volumes from Mexico and the Southwest are limited; Canadian sweet corn is still weeks away.

- Grapes: Green grape quality is poor; red grapes have stabilized but remain inconsistent in size and firmness.

- Blueberries: Limited volume from Eastern Canada and the U.S.; transition to local harvests may relieve pressure in late July.

- Garlic: California supplies tight; expect increased use of imported product with higher pricing.

- Celery: Strong demand and short supply have driven prices well above seasonal norms.

- Broccoli & Cauliflower: Cooler-than-expected weather in key growing areas has delayed harvests; prices remain firm.

- Red & Yellow Bell Peppers: Lower yields and high demand continue to push prices upward.

Consider Frozen with Alasko!

When fresh produce is limited or prices are high, Alasko provides a reliable solution with a full range of high-quality frozen fruits and vegetables.

We look forward to your questions, feedback and suggestions. Contact: Randy@gbfs.ca