Leslie Ewing, executive director at Plant-Based Foods of Canada, is bullish on plants. She represents 28 member companies who make or market plant-based products in Canada. In 2019, plant-based foods in Canada were worth $500 million, with an annual nominal growth of 16%.

According to the National Research Council of Canada, annual global sales of plant-based meat alternatives have grown on average 8% a year since 2010, with projections forecasting that by 2040, 20% of all meat consumed will consist of plant-based and clean meat. Currently, global plant-based meat is sized at roughly $4B US. Between 2020 and 2027, global sales are estimated to grow at a compound annual rate of about 20%.

Projections forecast that by 2040, 20% of all meat consumed will consist of plant-based and clean meat.

National Research Council of Canada

Disruptors abound

The first question that foodservice manufacturers consider before committing resources to a new food trend is “why.” Based on the tier of players involved and the multi-billion dollar opportunity, there’s no question at this point that plant-based meat is happening. The issue for foodservice operators is to look at the questions of “what” and “how.”

Leslie Ewing notes that the plant-based meat market is about more than just soy-based versus pea-based. “(Many of our members are labelling their plant-based meat) GMO-free, or organic, or Certified Plant Based. But the reality is that a wide variety of factors go into most people’s food choices. That’s why we see this less about being a binary shift (soy to pea) but rather a diversification of new protein sources. That includes soy and pea, but also now includes new ways of using almonds, coconuts, cashews, and hemp.”

Established meat players and the primary plant-based market makers will increasingly be challenged by new disruptors seeking to carve out their slice of the market. Century Pacific Foods, a large integrated protein player based in The Phillipines, is poised to launch the unMEAT burger. Rather than being a me-too competitor, unMEAT is poised to change the foodservice game. unMEAT’s product cost is significantly closer to parity with animal-based protein. It is also non-GMO, 0% cholesterol & trans-fat, and carries an ingredient deck with half as many items that are more recognizable to consumers — soy protein, vegetable oil, onion, wheat, salt, vinegar, and soy sauce.

In its first year of operating, plant-based venture capital fund LIVEKINDLY Collective pulled in over $500M in capital to fund global expansion. One of the brands that LIVEKINDLY acquired was Swedish innovator “Oumph!” brands. Oumph has grown dramatically across the Nordic countries, and the UK. It’s poised to launch in North America in 2021. Oumph! has taken plant-based to the next level. Their “Epic Veggie Eating” products achieve near analogue flavour and performance to traditional animal protein. The plant-based line includes Sticky Smokehouse meatless ribs, flavoured kebabs, burgers, and sausages. Oumph!’s core protein chunk product ingredient deck is pure simplicity — water, soya protein, and salt. In the UK, Oumph! is sold at major retailers like Tesco, Asda, and Whole Foods Market, as well as regional chain restaurants, institutional caterers, and Hilton Hotels.

Putting money where their mouth is

In 2020, the federal government announced $100 million of targeted financing for the development of plant-based foods by Merit Functional Foods in Winnipeg, Man. The company has built a state-of-the-art facility to create pea, canola and discruptive custom blended proteins, to be used in innovative plant-based protein solutions. This is a big bet, but it’s a safe one.

One of the fastest growing plant-based meat brands in the U.K., Meatless Farm Co., made a similar wager early in 2021, opening a Lovingly Made Ingredients facility in Calgary. The Calgary plant was established to manufacture textured plant-based proteins and starches. The location in the Canadian Prairies was conceived to use local crops close to source, consistent with the overall corporate goal of reducing the environmental footprint of the protein we consume.

Can’t stop the train — get on it

According to the SPINS/IRI retail tracking database, the plant-based meat trend accelerated during the COVID-19 pandemic. Plant-based meat sales in the U.S. exploded during COVID, and were 50% higher than animal-based meat sales during peak panic buying in 2020 in a trend being mirrored in Canada.

Based on current modelling, the market is already anticipating one-in-every-five-pounds of protein sold being plant-based. But the train’s not stopping there. Using extrudable fat technology partially developed at the University of Guelph, Motif Foodworks will be launching multiple products in the next 12 months that will provide “veining and marbling” effects to plant-based meats. Adding this layer of fat texture will speed up adoption even more. It’s beyond time for foodservice operators to get on board with beyond-meat products that help grow restaurants’ bottom line.

Check out the huge spectrum of plant-based options

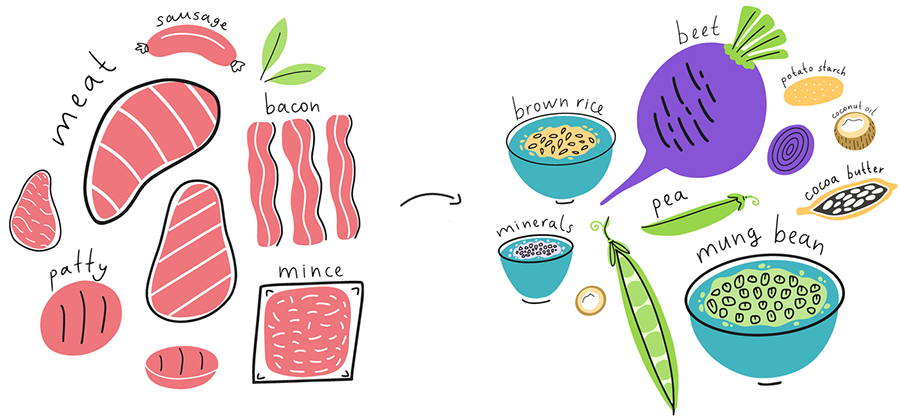

More and more manufacturers are getting into creating plant-based options that mimic the appearance and mouth feel of meat. Many restaurant diners continue to look for something that reminds them of meat without the guilt of actually consuming meat-based products. Major players like Maple Leaf are delivering, often with the help of food scientists.

Here are some of the major players adding plants to the growing menu:

Pea / Pulses

Supplier: Beyond Meat (U.S.)

| Offering | Beyond Burger 3.0 |

| Uniqueness | Latest iteration of flagship product, plant protein drawn from Pea, Mung Bean, Faba Bean and Brown Rice, offers 35% less saturated fat, 75% more iron than comparable plant/meat blends, and a “meatier” flavour |

| Status | Launching at retail and in Foodservice QSR in June 2021 |

Supplier: Sweet Earth – Awesome (Nestle — U.S.)

| Offering | Awesome Burger 2.0 + Vegan Jumbo Hot Dogs |

| Uniqueness | Updated burger has eliminated wheat gluten, and enhanced protein by adding fava and hemp blend to pea protein base |

| Status | Launched May 2021 in US retail at Walmart, Kroger, Target, Costco, etc. Test marketed at Jack in the Box in October 2020 Full foodservice launch by mid-to-late 2021 European launch of expanded product line planned for 2021 |

Supplier: Raised & Rooted (Tyson — U.S.)

| Offering | Nuggets & Patties 2.0 |

| Uniqueness | Relaunched plant-based nuggets and patties as vegan by eliminating egg whites and all animal products The line is pea protein isolate and flax based, is non-GMO, non-palm oil, and contain no artificial colors, flavors or preservatives |

| Status | January 2021 in US retail at Walmart, Kroger, Target, Costco, etc. Test marketed at Jack in the Box in October 2020 Full foodservice launch by mid-to-late 2021 European launch of expanded product line planned for 2021 |

Soy

Supplier: Impossible Foods (U.S.)

| Offering | Impossible Burger / Sausage |

| Uniqueness | Protein drawn from soy and potatoes, flavour derives from heme sourced from genetically engineered yeast |

| Status | Widely available in retail and foodservice (Burger King, Starbucks) |

Supplier: Century Pacific Foods (Phillipines)

| Offering | unMEAT |

| Uniqueness | Low cost clean label soy-based burger Non-GMO plant-based ingredients, 0% cholesterol & trans-fat |

| Status | Launch in U.S. retail planned for 2021 |

Wheat

Supplier: Loryma (Crespel & Deiters Group) — German wheat ingredient developer

| Offering | Vegan bacon |

| Uniqueness | Mimics pork bacon, crisps in pan, fibrous texture, meaty mouthfeel |

| Status | Prototype |

Blends — Animal + Plant Protein

Supplier: Maple Leaf Foods

| Offering | Line of items — Burger, Breakfast Sausage, Dinner Sausage, Ground |

| Uniqueness | Fuses animal-based and plant-based pea protein to achieve lighter meat footprint, with no compromise in texture and taste |

| Status | Retail launch — June 2020 |